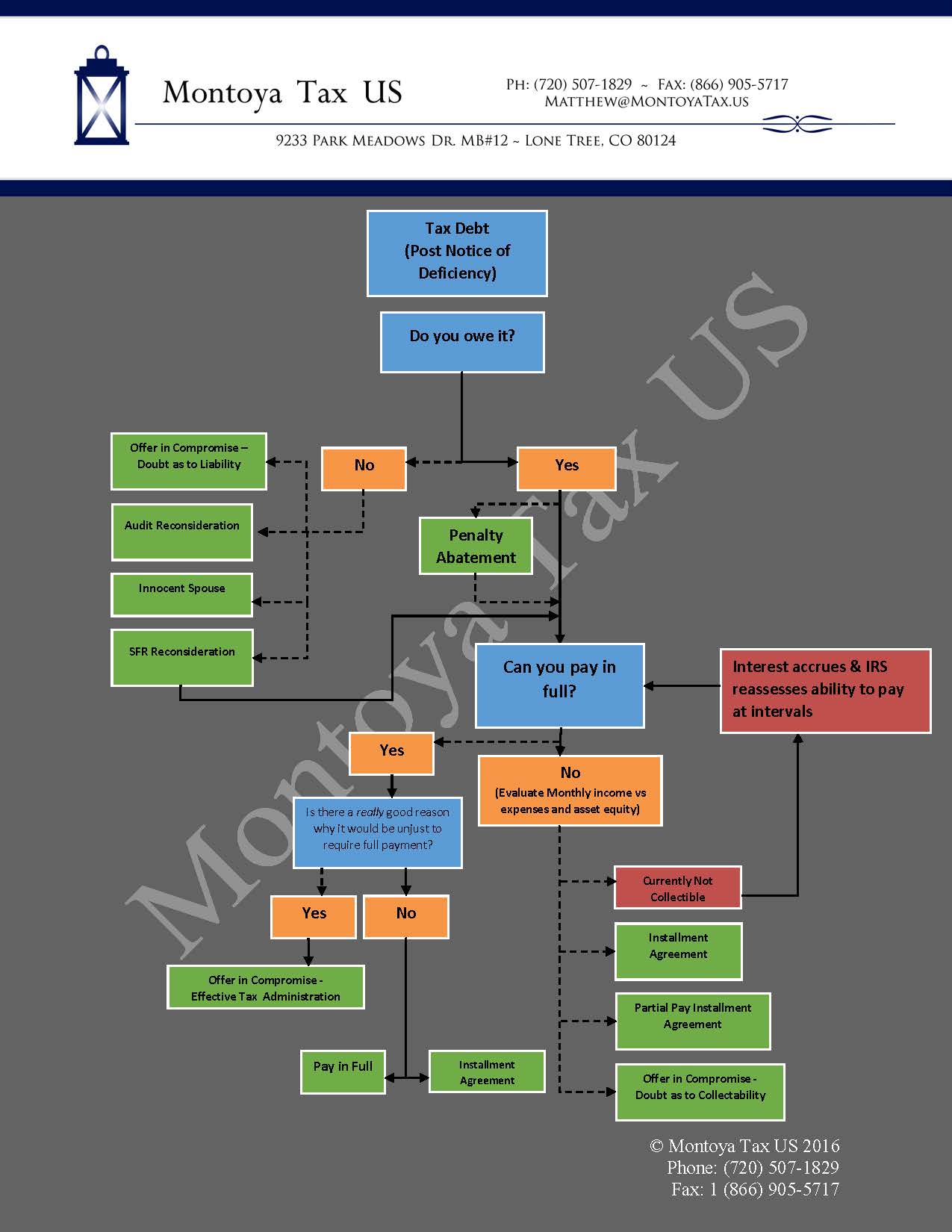

There are a variety of ways that a taxpayer can owe tax debt. Sometimes, it’s because the IRS made changes to the tax return you filed, and other times, it’s because of a substitute tax return the IRS created and filed on your behalf. Regardless, the IRS has already sent a letter saying that you owe a sum of money and intend to collect. Fortunately, there are many ways that a taxpayer can deal with this debt, assuming they fit certain criteria. The chart below provides a sampling of some of the more common options a taxpayer may have in looking to resolve their tax debt. However, each case is different, and the options available will depend heavily on the facts of the case. If you need help resolving tax debt, feel free to contact us.

For more information, see: